The Basic Principles Of Hsmb Advisory Llc

The Basic Principles Of Hsmb Advisory Llc

Blog Article

The Basic Principles Of Hsmb Advisory Llc

Table of ContentsThe 30-Second Trick For Hsmb Advisory LlcThe Only Guide to Hsmb Advisory LlcA Biased View of Hsmb Advisory LlcTop Guidelines Of Hsmb Advisory LlcLittle Known Facts About Hsmb Advisory Llc.Hsmb Advisory Llc for Beginners

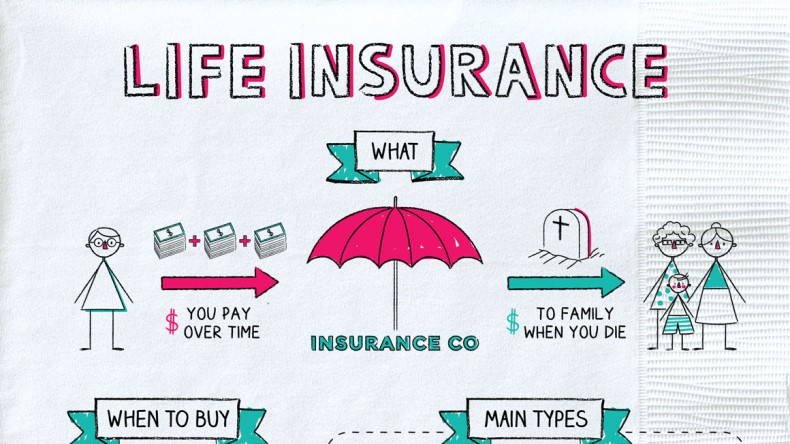

Ford claims to stay away from "cash worth or long-term" life insurance policy, which is even more of a financial investment than an insurance policy. "Those are extremely made complex, come with high payments, and 9 out of 10 individuals do not require them. They're oversold since insurance agents make the biggest commissions on these," he states.

Disability insurance policy can be costly. And for those that opt for lasting treatment insurance policy, this policy may make special needs insurance coverage unneeded.

Getting My Hsmb Advisory Llc To Work

If you have a persistent health issue, this kind of insurance can end up being essential (Health Insurance). Don't let it emphasize you or your bank account early in lifeit's typically best to take out a policy in your 50s or 60s with the anticipation that you won't be using it till your 70s or later.

If you're a small-business owner, take into consideration safeguarding your income by buying company insurance policy. In case of a disaster-related closure or period of restoring, organization insurance policy can cover your income loss. Consider if a considerable weather occasion affected your shop or manufacturing facilityhow would that influence your revenue? And for for how long? According to a report by FEMA, between 4060% of small companies never ever reopen their doors complying with a catastrophe.

And also, using insurance coverage might occasionally cost even more than it conserves over time. If you obtain a chip in your windscreen, you may consider covering the fixing expense with your emergency savings rather of your car insurance. Why? Due to the fact that utilizing your automobile insurance policy can trigger your regular monthly premium to rise.

Not known Details About Hsmb Advisory Llc

Share these ideas to safeguard enjoyed ones from being both underinsured and overinsuredand talk to a trusted specialist when needed. (http://peterjackson.mee.nu/do_you_ever_have_a_dream#c1981)

Insurance coverage that is purchased by an individual for single-person protection or coverage of a household. The private pays the premium, as opposed to employer-based wellness insurance coverage where the click for more info company commonly pays a share of the costs. People may go shopping for and acquisition insurance coverage from any type of plans readily available in the person's geographical region.

People and family members might qualify for monetary assistance to decrease the price of insurance coverage costs and out-of-pocket expenses, however only when enlisting through Link for Wellness Colorado. If you experience specific adjustments in your life,, you are qualified for a 60-day duration of time where you can sign up in a specific plan, even if it is outside of the annual open registration period of Nov.

15.

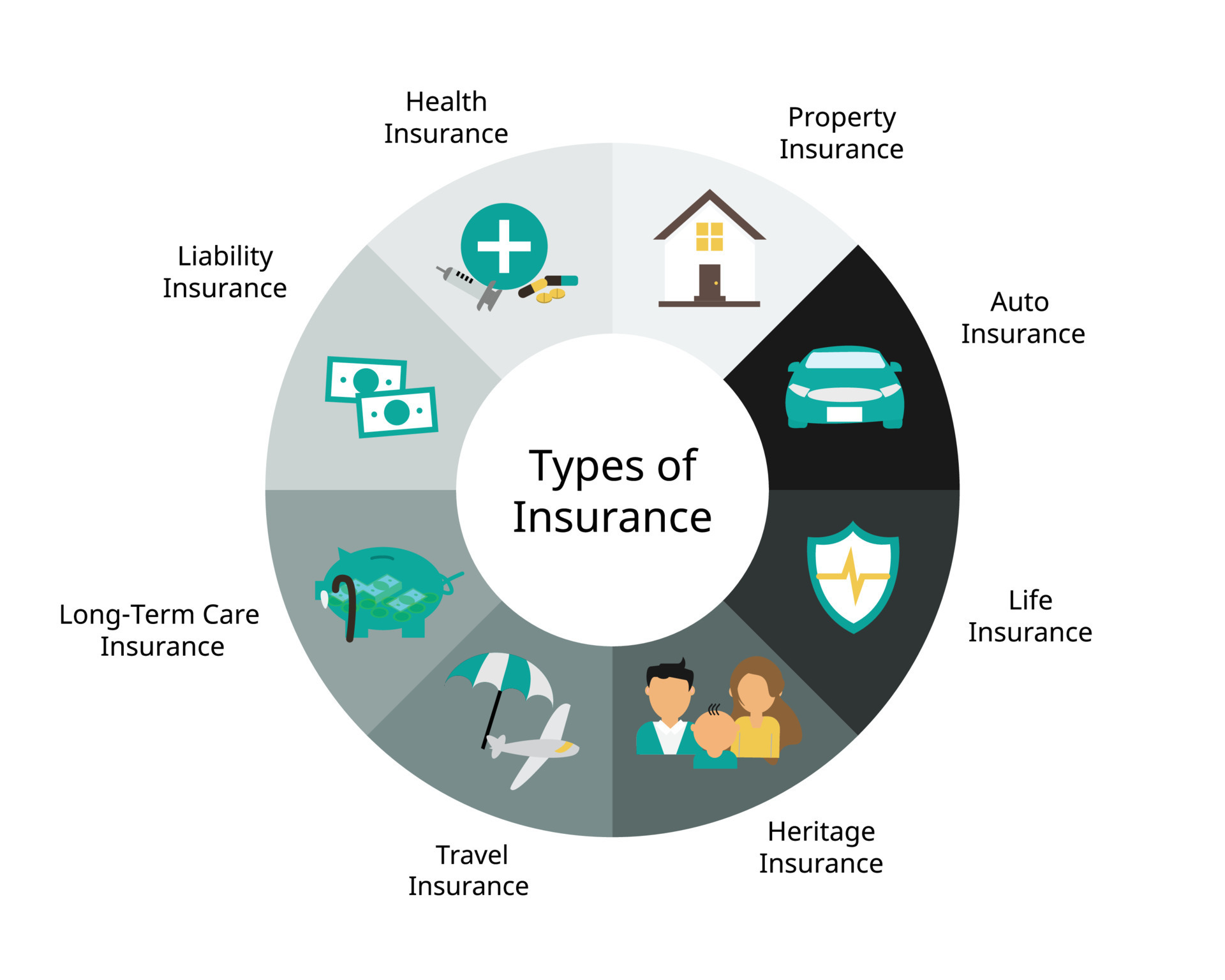

It might appear straightforward yet comprehending insurance policy types can also be puzzling. Much of this confusion comes from the insurance policy market's ongoing objective to design customized protection for policyholders. In creating adaptable plans, there are a selection to select fromand every one of those insurance coverage types can make it challenging to recognize what a certain plan is and does.

All About Hsmb Advisory Llc

If you die throughout this duration, the person or people you have actually named as recipients might get the cash money payment of the policy.

Lots of term life insurance policy policies allow you transform them to a whole life insurance coverage policy, so you don't lose insurance coverage. Generally, term life insurance plan costs repayments (what you pay each month or year right into your plan) are not secured at the time of purchase, so every five or 10 years you possess the policy, your costs can rise.

They additionally tend to be more affordable general than whole life, unless you acquire a whole life insurance policy plan when you're young. There are also a few variations on term life insurance coverage. One, called group term life insurance policy, is common among insurance options you might have accessibility to with your company.

The Buzz on Hsmb Advisory Llc

This is commonly done at no expense to the worker, with the capability to acquire additional insurance coverage that's obtained of the employee's paycheck. An additional variation that you could have accessibility to with your company is supplemental life insurance (Insurance Advise). Supplemental life insurance policy can consist of unintended death and dismemberment (AD&D) insurance coverage, or funeral insuranceadditional insurance coverage that might aid your family in case something unexpected occurs to you.

Long-term life insurance policy simply describes any kind of life insurance policy plan that doesn't end. There are several sorts of irreversible life insurancethe most common kinds being entire life insurance policy and global life insurance policy. Entire life insurance policy is precisely what it appears like: life insurance for your entire life that pays to your beneficiaries when you die.

Report this page